The bank will have sold more than 150,000 million toxic assets by the end of the year

The bank will sell more than 50,000 million euros in real estate banking assets.

Since 2014, about 1000 billion bank assets have been sold.

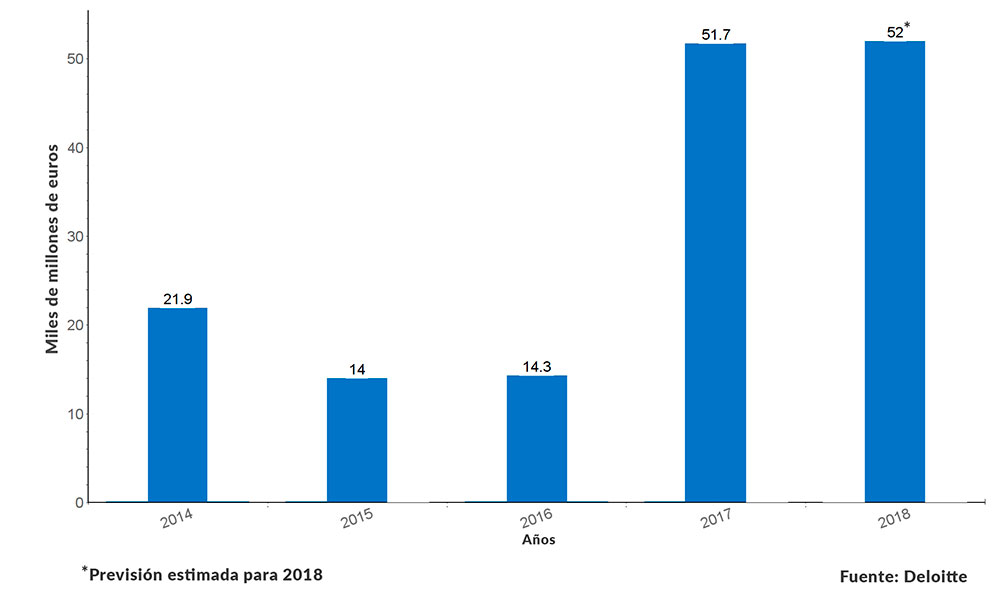

Following the recommendations of the ECB (European Central Bank), the bank has carried out the sale of large portfolios with the aim of releasing its unproductive assets. For four years, the bank has disposed of them for an amount of almost 102,000 million euros, mainly directed at large real estate investment funds.

Sale of toxic banking real estate assets

The data of the ECB reflect that the Spanish financial system accumulated 106.220 million euros in assets linked to the crisis at the end of 2017.

Real estate operations of banking

After CaixaBank closed the sale of its real estate business to LoneS There are still two major operations to be completed in 2018 by Sabadell and Sareb. The first studies to close the sale of 10.9 billion euros of unproductive assets before August.

However, it was Santander who inaugurated these "mega-operations" with the sale of 30,000 million euros to a joint venture with Blackstone . And for its part, BBVA agreed with Cerberus the divestment of 13,000 million euros in real estate assets.

According to Deloitte, the largest sellers of bank assets in 2017 were: Santander (30.5 billion of euros), BBVA (13.2), CaixaBank (2), Sabadell (1.3) and Bankia (1.1).

In general, the entire banking sector is carrying out mass sales operations of your real estate banking assets.

International real estate funds

Buyers of these assets tend to be opportunistic funds. As the Deloitte studies show, in 2017 the most active were:

- Blackstone (30,700 million)

- Cerberus, (13,000 million)

- Bain Capital, (1,300 million)

- Lindorff (1,200 million)

- Deutsche Bank (1,100 million euros)

Therefore, it is estimated that at the end of the year banks have disposed of more than 150,000 toxic assets inherited from the crisis.

Related news bank assets:

Foreign investment funds plus portfolio buyers in Europe

The bank will maintain its upward trend in the sale of real estate portfolios

The most active entities in the sale of delinquent portfolios: Sant ander, Sabadell and BBVA